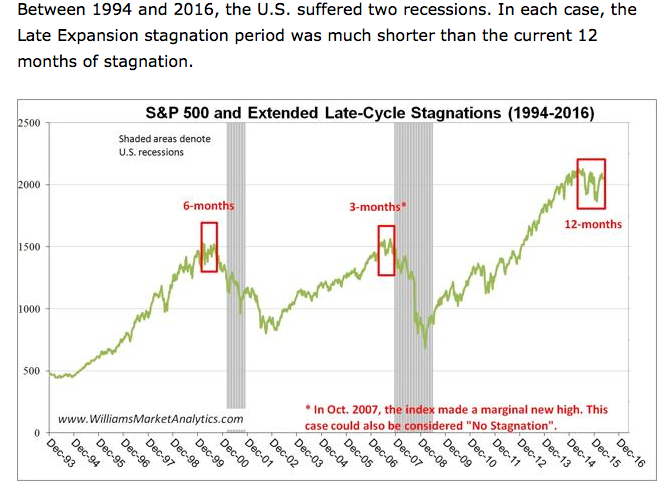

Late Stage Stagnation of S&P 500

Read More: http://seekingalpha.com/article/3978284-sell-may-fails

Seeking Alpha: The 12-month period of stagnation during which the S&P 500 has failed to make a new expansion high, should be a concern for equity investors. The precedent stagnation periods have reflected growing doubts among investors about the perennity of the economic expansion. Why has the current stagnation period on the S&P 500 been so long relative to the prior cases? Most likely due to the belief among many investors that the central bank will be able to forestall the next recession with extraordinary monetary policy. When investors collectively realize that the "emperor has no clothes", and worse, that counter-cyclical monetary tools have not been replenished by the central bank during this expansion, we would bet that the 12-month equity stagnation translates into a much more painful equity draw-down during the upcoming recession.

We have also concluded that, based on empirical data, a Sell-In-May effect does not have strong predictive power for returns through the Summer and early Autumn.

- Log in to post comments