Analysis of Market Returns over 12-Year Horizon

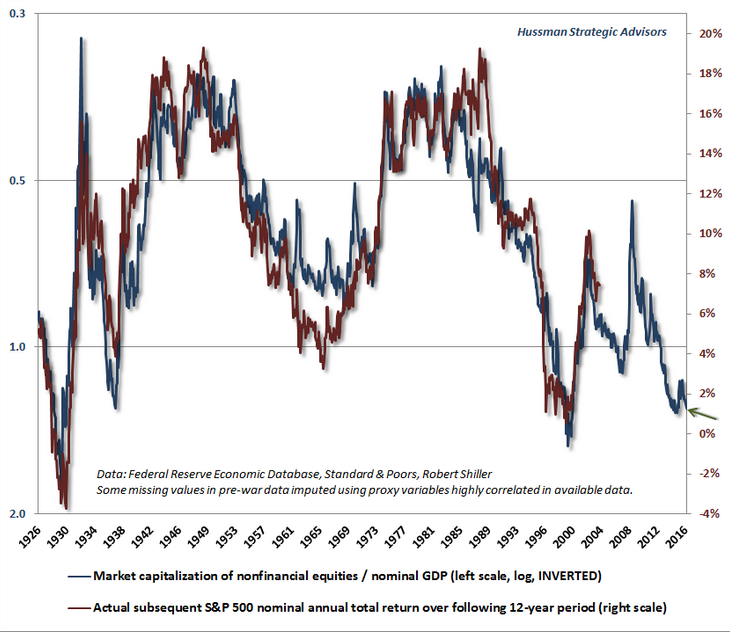

"The danger of the current iteration of “this time it’s different,” I think, is in how elaborate and far-reaching the underlying fallacies have become. By equating the delay of consequences with the absence of consequences, investors have now set up the most extreme episode of equity market speculation in U.S. history next to the 1929 and 2000 market peaks, and the broadest episode of general financial market speculation outside of the 11-month period from November 1928 to September 1929 (as measured by the estimated prospective 12-year total return on a conventional portfolio mix of 60% stocks, 30% bonds and 10% Treasury bills)."

- Log in to post comments