Value at Risk (VAR)

An example from Wikipedia.

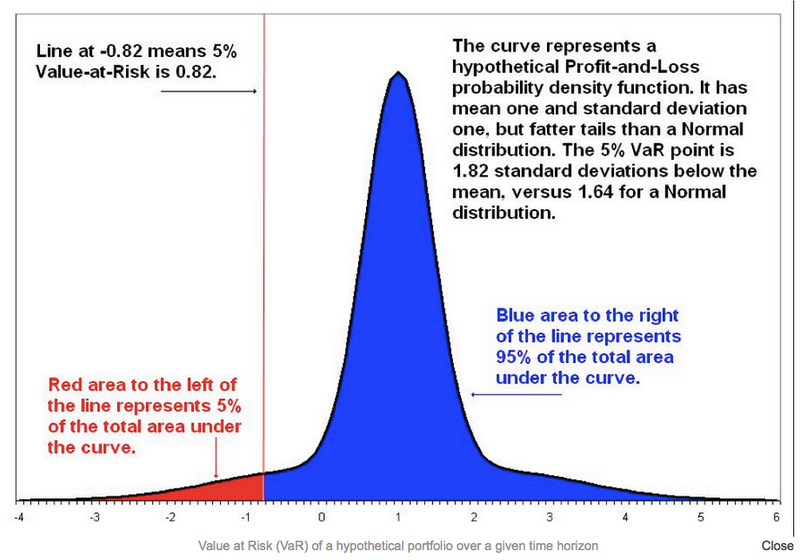

In financial mathematics and financial risk management, value at risk (VaR) is a widely used risk measure of the risk of loss on a specific portfolio of financial assets. For a given portfolio, probability and time horizon, VaR is defined as a threshold value such that the probability that the mark-to-market loss on the portfolio over the given time horizon exceeds this value (assuming normal markets and no trading in the portfolio) is the given probability level.

For example, if a portfolio of stocks has a one-day 5% VaR of $1 million, there is a 0.05 probability that the portfolio will fall in value by more than $1 million over a one day period if there is no trading. Informally, a loss of $1 million or more on this portfolio is expected on 1 day out of 20 days (because of 5% probability). A loss which exceeds the VaR threshold is termed a "VaR break."

Common parameters for VaR are 1% and 5% probabilities and one day and two week horizons, although other combinations are in use. The reason for assuming normal markets and no trading, and to restricting loss to things measured in daily accounts, is to make the loss observable.

In some extreme financial events it can be impossible to determine losses, either because market prices are unavailable or because the loss-bearing institution breaks up. VaR marks the boundary between normal days and extreme events. Institutions can lose far more than the VaR amount; all that can be said is that they will not do so very often.

- Log in to post comments